Apply for a business current account

Key benefits:

- A direct line to your own relationship manager

- No monthly fees plus up to 1.5% cashback on all eligible card spend*

- 4.08% AER* (variable) instant access Savings Pot

*Terms and conditions apply – click to read more.

NO MONTHLY FEE* 4.08% AER (Variable) INTEREST ON SAVINGS Up to 1.5% CASHBACK UK SUPPORT

All our current accounts and savings accounts are covered by the Financial Services Compensation Scheme (FSCS). This means that, should anything happen to Standard Secure Bank Bank, any eligible deposit of up to £85,000 will be protected.

Find out more about your eligibility for FSCS coverage here.

Instant-access

Savings Pot

Our Savings Pot is an exclusive feature of our Business Rewards Account. You can earn 4.08% AER* on savings while you continue to earn from your spending.

- Instant access – deposit or withdraw

funds 24/7. - 4.08% AER* (variable) interest rate

- An exclusive feature of the Business Rewards Account.

- FSCS protection (eligible deposits only).

- Get a dedicated relationship manager.

*Terms and conditions apply – click to read more.

4.08% AER* (variable) integrated Savings Pot

Don’t just earn cashback. Earn interest on your savings too. Savings Pots are an exclusive feature of the Business Rewards Account.

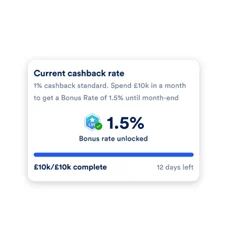

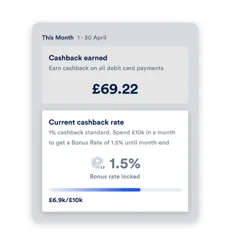

Up to 1.5% cashback*

Earn 1% cashback on your card spend and unlock 1.5% cashback on additional monthly card spend after you spend £10k in a month*

Your relationship manager

Get a dedicated relationship manager that will be with you every step of the way. We believe in building relationships, not call centres.

No monthly fees*

As long as you continue to meet our eligibility criteria.*

Get rewarded for your card spend

Here’s how it works…

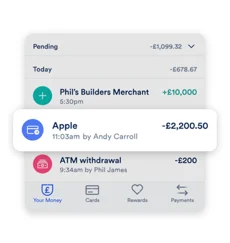

1. Make a card payment

Use it just like your current business bank account and track your payments in the app.

2. Get rewarded

Earn 1% cashback on all eligible card payments, paid at the end of the month.

3. Unlock bonus rewards!

Spend over £10k in one month and unlock a bonus rate of 1.5% for the rest of the month.

A Business Rewards Account

built for businesses like yours

| Zero monthly fees | ✔* |

| Free Faster Payments | ✔* |

| Free BACS | ✔* |

| 1% cashback on card payments | ✔ |

| 1.5% cashback on card payments after £10k spent in a month for remainder of month | ✔ |

| UK-based support team | ✔ |

| FSCS protection (if eligible) | ✔ |

| Manage using mobile app | ✔ |

| Manage on the web | ✔ |

| Direct credits in | ✔ |

| Multiple director access and cards | ✔ |

| Integrate with Sage and Xero | ✔ |

| Direct Debits out | ✔ |

| Schedule payments | ✔ |

| ATM withdrawals | ✔ |

| Phone support | ✔ |

| CHAPS payments | ✔ (For a fee of £20) |

| Deposit cash | ✘ |

| Deposit cheques | ✘ |

| Integrated savings pots with 4.08% AER interest | ✔* |

| Bulk Payments | ✔ (No fees) |

| Two-person authorisation | ✔ |

| Relationship manager | ✔ |

*Terms and conditions apply – click to read more.

Switching bank account? It’s easier than you think.

Switching accounts is hassle-free with the Current Account Switch Service (CASS).*

All your direct debits and standing orders will be moved over to your new account automatically within seven days. Then, after the switch and for the next three years, any money sent to your old account will be redirected to your new one. It’s as easy as…

- Open your new current account

- Choose a switch date

- We’ll do the rest

Find out more about the Current Account Switch Service here.

*Terms and conditions apply – click to read more.